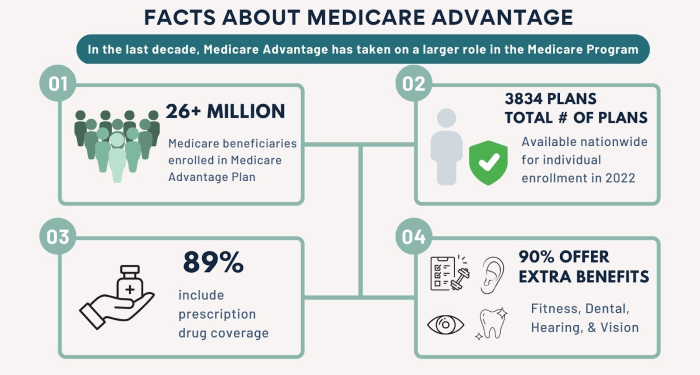

Delve into the complexities of selecting a Medicare Advantage Plan with our guide, exploring crucial factors and considerations that can impact your healthcare decisions.

Discover the ins and outs of these plans and how they can shape your medical coverage in unforeseen ways.

Understanding Medicare Advantage Plans

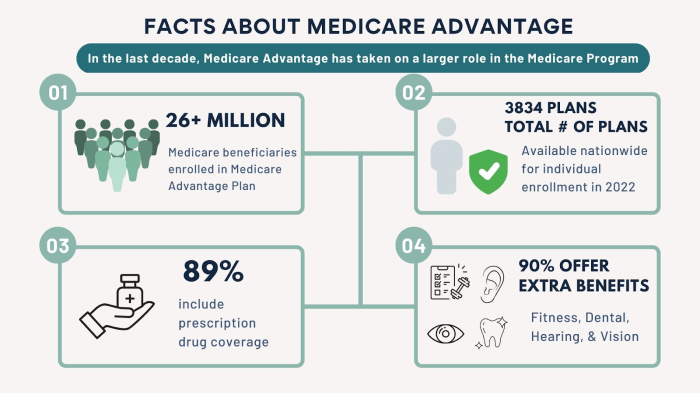

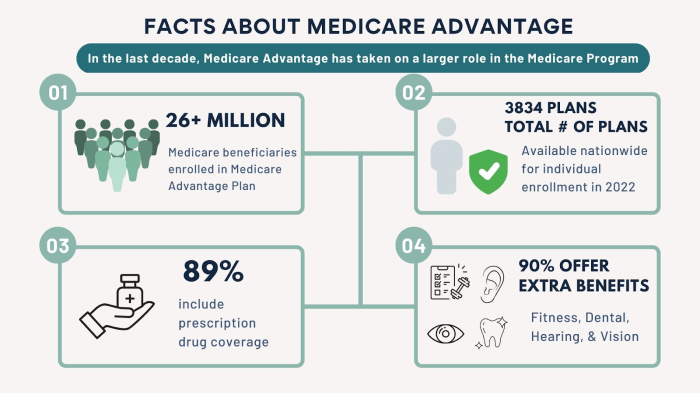

Medicare Advantage Plans, also known as Medicare Part C, are health insurance plans offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage options.

Types of Coverage Offered by Medicare Advantage Plans

Medicare Advantage Plans typically offer the following types of coverage:

- Hospital insurance (Part A)

- Medical insurance (Part B)

- Prescription drug coverage (Part D)

Additional Benefits Included in Medicare Advantage Plans

Aside from the basic coverage, Medicare Advantage Plans may also include extra benefits such as:

- Vision care

- Dental care

- Hearing aids

- Health and wellness programs

Factors to Consider Before Choosing a Medicare Advantage Plan

When selecting a Medicare Advantage plan, it's crucial to weigh various factors that can significantly impact your healthcare coverage and costs. Understanding these key considerations will help you make an informed decision tailored to your individual needs.

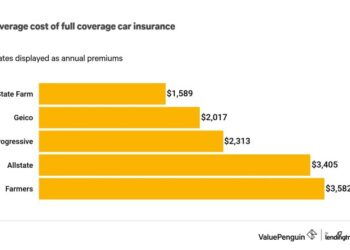

Costs

- Compare monthly premiums, deductibles, and copayments across different plans.

- Consider maximum out-of-pocket limits to ensure you can afford potential healthcare expenses.

Coverage Options

- Review the services and benefits included in each plan, such as vision, dental, and hearing coverage.

- Assess whether the plan covers services you anticipate needing based on your health history.

Network Restrictions

- Determine if your preferred healthcare providers, hospitals, and pharmacies are part of the plan's network.

- Understand the implications of seeking care outside the network and how it affects costs and coverage.

Additional Benefits

- Explore extra perks offered by certain plans, like fitness programs, telehealth services, or transportation assistance.

- Weigh the value of these additional benefits against the plan's overall costs and coverage.

Prescription Drug Coverage

- Check if the plan includes your current medications in its formulary and at what cost.

- Consider any restrictions or requirements for obtaining prescription drugs, such as prior authorizations or quantity limits.

Out-of-Pocket Expenses

- Calculate potential out-of-pocket costs for services not fully covered by the plan, like coinsurance amounts.

- Understand how copayments, coinsurance, and deductibles contribute to your overall healthcare expenses.

Comparing Medicare Advantage Plans

When it comes to choosing a Medicare Advantage Plan, comparing various options available in your area is crucial to ensure you find the best fit for your healthcare needs and budget. Here are some tips on how to effectively compare Medicare Advantage Plans:

Review the Plan’s Provider Network and Coverage Limitations

- Check if your current healthcare providers, such as doctors and specialists, are included in the plan's network. Ensure that the plan offers coverage for the services you need, like prescription drugs, vision, or dental care.

- Pay attention to any coverage limitations, such as restrictions on certain treatments or procedures. Make sure the plan covers the medications and treatments you require.

Check for Star Ratings or Reviews of the Plans

- Look for Medicare Advantage Plans with higher star ratings, as these indicate the quality and performance of the plan. Plans with higher ratings typically provide better customer satisfaction and healthcare outcomes.

- Read reviews from current or past plan members to get insights into their experiences with the plan. Consider any feedback on customer service, coverage, or overall satisfaction.

Enrollment and Disenrollment Periods

When it comes to Medicare Advantage Plans, understanding the enrollment and disenrollment periods is crucial for making informed decisions about your healthcare coverage.

Initial Enrollment Period

During your Initial Enrollment Period, which lasts for seven months, you can sign up for a Medicare Advantage Plan. This period begins three months before you turn 65, includes your birthday month, and extends three months after.

- It is important to enroll during this period to avoid potential gaps in coverage and late enrollment penalties.

Annual Enrollment Period (AEP)

The Annual Enrollment Period occurs from October 15th to December 7th each year. During this time, individuals can switch Medicare Advantage Plans or return to Original Medicare.

- Changes made during the AEP will take effect on January 1st of the following year.

Medicare Advantage Open Enrollment Period (MA OEP)

From January 1st to March 31st, individuals who are already enrolled in a Medicare Advantage Plan can make a one-time change. This allows them to switch to a different Medicare Advantage Plan or return to Original Medicare with or without a Part D plan.

- Changes made during the MA OEP will take effect the first of the following month after the change is made.

It is crucial to be aware of these enrollment periods to avoid any penalties or consequences for late enrollment or disenrollment outside of the designated periods.

Ultimate Conclusion

In conclusion, navigating the realm of Medicare Advantage Plans demands attention to detail and a thorough understanding of your healthcare needs. This guide aims to empower you in making informed choices for a healthier future.

FAQ Resource

What if I need specialized care not covered by a Medicare Advantage Plan?

If your plan doesn't cover a specific service, you may need to pay out-of-pocket or explore other coverage options like supplemental insurance.

Can I switch my Medicare Advantage Plan at any time?

You can typically switch plans during certain enrollment periods, but exceptions may apply in special circumstances.

Are all prescription drugs covered under Medicare Advantage Plans?

No, coverage varies by plan, so it's essential to review the formulary to ensure your medications are included.

What happens if I move out of the plan's service area?

If you relocate outside the plan's coverage area, you may be eligible for a Special Enrollment Period to choose a new plan or return to Original Medicare.

Is dental or vision coverage included in Medicare Advantage Plans?

Some plans offer limited dental and vision benefits, but you may need to purchase additional coverage for comprehensive care in these areas.

Delve into the complexities of selecting a Medicare Advantage Plan with our guide, exploring crucial factors and considerations that can impact your healthcare decisions.

Discover the ins and outs of these plans and how they can shape your medical coverage in unforeseen ways.

Understanding Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, are health insurance plans offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage options.

Types of Coverage Offered by Medicare Advantage Plans

Medicare Advantage Plans typically offer the following types of coverage:

- Hospital insurance (Part A)

- Medical insurance (Part B)

- Prescription drug coverage (Part D)

Additional Benefits Included in Medicare Advantage Plans

Aside from the basic coverage, Medicare Advantage Plans may also include extra benefits such as:

- Vision care

- Dental care

- Hearing aids

- Health and wellness programs

Factors to Consider Before Choosing a Medicare Advantage Plan

When selecting a Medicare Advantage plan, it's crucial to weigh various factors that can significantly impact your healthcare coverage and costs. Understanding these key considerations will help you make an informed decision tailored to your individual needs.

Costs

- Compare monthly premiums, deductibles, and copayments across different plans.

- Consider maximum out-of-pocket limits to ensure you can afford potential healthcare expenses.

Coverage Options

- Review the services and benefits included in each plan, such as vision, dental, and hearing coverage.

- Assess whether the plan covers services you anticipate needing based on your health history.

Network Restrictions

- Determine if your preferred healthcare providers, hospitals, and pharmacies are part of the plan's network.

- Understand the implications of seeking care outside the network and how it affects costs and coverage.

Additional Benefits

- Explore extra perks offered by certain plans, like fitness programs, telehealth services, or transportation assistance.

- Weigh the value of these additional benefits against the plan's overall costs and coverage.

Prescription Drug Coverage

- Check if the plan includes your current medications in its formulary and at what cost.

- Consider any restrictions or requirements for obtaining prescription drugs, such as prior authorizations or quantity limits.

Out-of-Pocket Expenses

- Calculate potential out-of-pocket costs for services not fully covered by the plan, like coinsurance amounts.

- Understand how copayments, coinsurance, and deductibles contribute to your overall healthcare expenses.

Comparing Medicare Advantage Plans

When it comes to choosing a Medicare Advantage Plan, comparing various options available in your area is crucial to ensure you find the best fit for your healthcare needs and budget. Here are some tips on how to effectively compare Medicare Advantage Plans:

Review the Plan’s Provider Network and Coverage Limitations

- Check if your current healthcare providers, such as doctors and specialists, are included in the plan's network. Ensure that the plan offers coverage for the services you need, like prescription drugs, vision, or dental care.

- Pay attention to any coverage limitations, such as restrictions on certain treatments or procedures. Make sure the plan covers the medications and treatments you require.

Check for Star Ratings or Reviews of the Plans

- Look for Medicare Advantage Plans with higher star ratings, as these indicate the quality and performance of the plan. Plans with higher ratings typically provide better customer satisfaction and healthcare outcomes.

- Read reviews from current or past plan members to get insights into their experiences with the plan. Consider any feedback on customer service, coverage, or overall satisfaction.

Enrollment and Disenrollment Periods

When it comes to Medicare Advantage Plans, understanding the enrollment and disenrollment periods is crucial for making informed decisions about your healthcare coverage.

Initial Enrollment Period

During your Initial Enrollment Period, which lasts for seven months, you can sign up for a Medicare Advantage Plan. This period begins three months before you turn 65, includes your birthday month, and extends three months after.

- It is important to enroll during this period to avoid potential gaps in coverage and late enrollment penalties.

Annual Enrollment Period (AEP)

The Annual Enrollment Period occurs from October 15th to December 7th each year. During this time, individuals can switch Medicare Advantage Plans or return to Original Medicare.

- Changes made during the AEP will take effect on January 1st of the following year.

Medicare Advantage Open Enrollment Period (MA OEP)

From January 1st to March 31st, individuals who are already enrolled in a Medicare Advantage Plan can make a one-time change. This allows them to switch to a different Medicare Advantage Plan or return to Original Medicare with or without a Part D plan.

- Changes made during the MA OEP will take effect the first of the following month after the change is made.

It is crucial to be aware of these enrollment periods to avoid any penalties or consequences for late enrollment or disenrollment outside of the designated periods.

Ultimate Conclusion

In conclusion, navigating the realm of Medicare Advantage Plans demands attention to detail and a thorough understanding of your healthcare needs. This guide aims to empower you in making informed choices for a healthier future.

FAQ Resource

What if I need specialized care not covered by a Medicare Advantage Plan?

If your plan doesn't cover a specific service, you may need to pay out-of-pocket or explore other coverage options like supplemental insurance.

Can I switch my Medicare Advantage Plan at any time?

You can typically switch plans during certain enrollment periods, but exceptions may apply in special circumstances.

Are all prescription drugs covered under Medicare Advantage Plans?

No, coverage varies by plan, so it's essential to review the formulary to ensure your medications are included.

What happens if I move out of the plan's service area?

If you relocate outside the plan's coverage area, you may be eligible for a Special Enrollment Period to choose a new plan or return to Original Medicare.

Is dental or vision coverage included in Medicare Advantage Plans?

Some plans offer limited dental and vision benefits, but you may need to purchase additional coverage for comprehensive care in these areas.