Exploring the realm of health insurance can be overwhelming, but with the right guidance, it can lead to peace of mind and security. In this guide, we delve into the crucial aspects of finding health insurances near you with the best reviews, helping you make informed decisions for your well-being.

Researching Health Insurance Providers

When looking for health insurance providers in your area, it is important to do thorough research to find the best one for your needs. This involves comparing coverage, benefits, and costs offered by different providers, as well as reading reviews and ratings from customers to get an idea of their reputation.

Identify the Top Health Insurance Providers in Your Area

- Start by compiling a list of health insurance providers in your area. This can be done through online research, recommendations from friends or family, or by contacting insurance brokers.

- Look for providers that have a strong presence in your area and offer a wide range of coverage options.

Compare Coverage, Benefits, and Costs

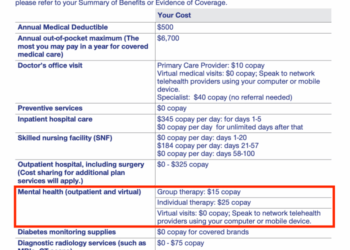

- Once you have a list of potential health insurance providers, compare the coverage options they offer. This includes services such as doctor visits, prescription drugs, and hospital stays.

- Consider the benefits included in each plan, such as wellness programs, telemedicine services, or discounts on gym memberships.

- Compare the costs of each plan, including monthly premiums, deductibles, copayments, and coinsurance. Make sure to factor in any out-of-pocket expenses you may incur.

Importance of Reading Reviews and Ratings

- Reading reviews and ratings from current and former customers can give you valuable insight into the quality of service provided by health insurance providers.

- Look for reviews that mention customer satisfaction, ease of claims processing, and overall experience with the provider.

- Pay attention to any common complaints or issues mentioned in reviews, as this can help you avoid potential problems with a provider.

Finding Health Insurances Near Me

Finding health insurances near you is essential for easy access to healthcare services. Here are some tips on how to search for health insurance providers nearby:

Utilizing Online Tools

One way to find health insurance options in your vicinity is by using online platforms like HealthCare.gov, eHealth, or Zocdoc. These websites allow you to enter your location and compare different health insurance plans available in your area.

Benefits of Choosing a Local Provider

Convenience

Having a health insurance provider nearby makes it easier to schedule appointments, visit healthcare facilities, and communicate with your insurance company.

Personalized Service

Local providers often offer more personalized customer service and better understanding of the specific healthcare needs in your community.

Community Support

By choosing a local health insurance provider, you are supporting the local economy and contributing to the well-being of your community.

Evaluating Health Insurance Reviews

When looking for health insurance, it's crucial to assess the credibility of reviews to make an informed decision. Reviews can provide valuable insights into the quality of service and customer experiences with different providers

Importance of Detailed Reviews

- Look for reviews that provide specific details about the reviewer's experience with the health insurance provider.

- Specific examples of claims processing, customer service interactions, or coverage issues can help paint a clearer picture of what to expect.

- Reviews that go beyond general statements and offer specific anecdotes are more likely to be authentic and helpful.

Filtering Out Biased or Fake Reviews

- Be wary of reviews that are overly positive or negative without providing specific reasons or examples.

- Check if the reviewer has a history of leaving extreme reviews, as this may indicate bias.

- Look for patterns in reviews across different platforms to identify potentially fake reviews.

- Consider the overall sentiment of multiple reviews rather than relying on a single review.

Selecting the Best Health Insurance Plan

When it comes to choosing the best health insurance plan for your needs, there are several key factors to consider. It's important to match your healthcare needs with the coverage offered by insurance plans while also balancing affordability with comprehensive coverage.

Matching Healthcare Needs with Coverage

- Consider your current health status and any ongoing medical conditions you may have.

- Look at the coverage options for services you frequently use, such as prescription medications, preventive care, or specialist visits.

- Check if the plan includes coverage for services you may need in the future, such as maternity care or mental health treatment.

Affordability versus Comprehensive Coverage

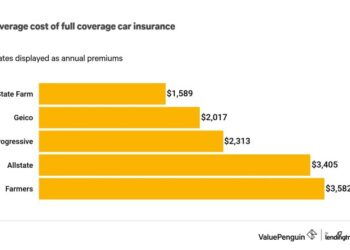

- Compare the monthly premiums of different plans to ensure it fits within your budget.

- Check the out-of-pocket costs, including deductibles, copayments, and coinsurance, to understand your financial responsibilities.

- Consider the network of healthcare providers included in the plan to ensure you have access to quality care without incurring additional costs.

Summary

Navigating the world of health insurance can be complex, but armed with knowledge about finding the best reviews for insurances near you, you are better equipped to make the right choice that suits your needs. This guide aims to empower you to make informed decisions about your health and financial security.

FAQ

How can I find the top health insurance providers in my area?

To find the best health insurance providers near you, consider researching online, asking for recommendations from friends or family, or using comparison websites to evaluate different options.

Why is it important to read reviews and ratings from customers?

Reading reviews and ratings from customers can provide valuable insights into the quality of service, coverage, and overall customer satisfaction with a health insurance provider, helping you make an informed decision.

How can I assess the credibility of health insurance reviews?

To assess the credibility of health insurance reviews, look for detailed reviews that mention specific experiences, check for consistency in feedback across multiple sources, and consider the reputation of the reviewer.

What key factors should I consider when selecting a health insurance plan?

When selecting a health insurance plan, key factors to consider include coverage options, network of healthcare providers, out-of-pocket costs, and whether the plan aligns with your healthcare needs and budget.