Exploring the dynamics of Progressive Commercial Auto Insurance: Cost vs Value, this introduction sets the stage for an insightful discussion that delves into the intricacies of insurance costs and benefits. It aims to captivate readers with a blend of informative content and engaging language style.

Continuing with a detailed overview of the various aspects surrounding Progressive Commercial Auto Insurance, this paragraph will provide a comprehensive understanding of the topic at hand.

Cost of Progressive Commercial Auto Insurance

When it comes to the cost of Progressive commercial auto insurance, several factors come into play that influence the overall pricing. These factors can range from the type of coverage selected to the driver's history and the specific needs of the business.

Factors Influencing Cost

- The type and amount of coverage required by the business

- The driving record of the employees operating the commercial vehicles

- The location where the vehicles will be primarily used

- The type of vehicles being insured

Types of Coverage and Cost

- Basic liability coverage will generally be more affordable compared to comprehensive coverage that includes additional protections.

- Adding collision coverage or uninsured motorist coverage can increase the cost of the insurance policy.

- Businesses with a high risk of accidents or claims may see higher premiums.

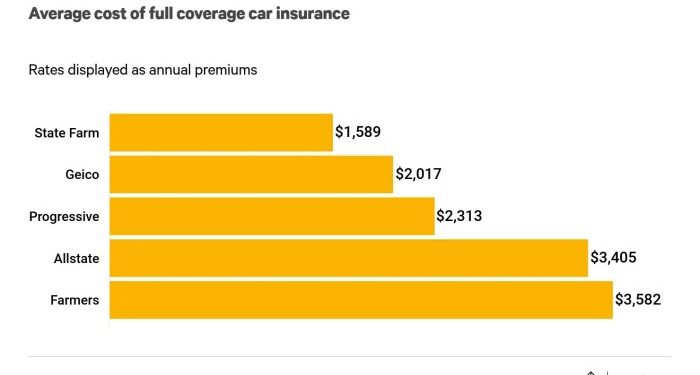

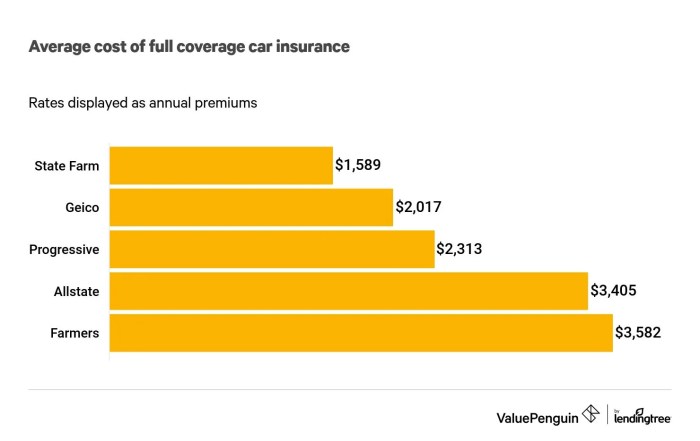

Comparison with Other Providers

- Progressive offers competitive rates for commercial auto insurance, but it's essential to compare quotes from other providers to ensure the best value.

- Factors like customer service, claims process, and additional benefits should also be considered when comparing costs with other insurance companies.

Value of Progressive Commercial Auto Insurance

Progressive commercial auto insurance offers a valuable proposition for businesses looking to protect their vehicles and assets. With a range of coverage options and additional services, Progressive aims to provide comprehensive protection tailored to the needs of commercial clients.

Real-World Examples of Benefits

- One construction company saw a significant decrease in downtime and repair costs after insuring their fleet with Progressive. The quick claims process allowed them to get back on the road faster, minimizing disruptions to their projects.

- A delivery service company experienced peace of mind knowing that their drivers were covered in case of accidents or emergencies. This assurance allowed them to focus on growing their business without worrying about potential liabilities.

Additional Services and Benefits

- 24/7 customer support for claims assistance and policy inquiries.

- Fleet tracking and management tools to optimize routes and improve efficiency.

- Rental reimbursement coverage to ensure business operations can continue even if a vehicle is temporarily out of commission.

- Customizable policies to fit the specific needs and budget of each business, offering flexibility and peace of mind.

Coverage Options and Flexibility

When it comes to Progressive commercial auto insurance, businesses have access to a variety of coverage options that can be tailored to their specific needs.

Liability Coverage

- Provides protection in case your business is held responsible for damages or injuries caused to others in an accident.

- Essential for businesses that frequently transport goods, employees, or clients.

Comprehensive Coverage

- Covers damage to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Beneficial for businesses with valuable vehicles or operating in high-risk areas.

Collision Coverage

- Pays for damages to your vehicle in the event of a collision with another vehicle or object.

- Ideal for businesses with a fleet of vehicles that are at a higher risk of accidents.

Medical Payments Coverage

- Provides coverage for medical expenses for you and your passengers regardless of fault.

- Important for businesses that transport employees or clients regularly.

Claims Process and Customer Service

When it comes to commercial auto insurance, the claims process and customer service are crucial aspects for businesses. Progressive aims to provide a smooth experience for their commercial auto insurance customers, ensuring quick and efficient resolution of claims.

Claims Process for Progressive Commercial Auto Insurance

- Progressive offers a simple and straightforward claims process for commercial auto insurance customers.

- Customers can file claims online, through the mobile app, or by calling the claims department.

- Once a claim is filed, Progressive assigns a dedicated claims representative to assist throughout the process.

- The claims team works efficiently to assess the damage, evaluate liability, and process the claim in a timely manner.

- Progressive also offers the option for businesses to track the progress of their claims online for transparency and peace of mind.

Customer Service Feedback for Progressive Commercial Auto Insurance

- Customer reviews praise Progressive's customer service for commercial auto insurance, citing helpful and knowledgeable representatives.

- Business owners appreciate the personalized attention and prompt responses from Progressive's customer service team.

- Progressive has been recognized for its excellent customer service in the insurance industry, adding value to their commercial auto insurance offerings.

Ensuring a Smooth Claims Experience for Businesses

- Progressive focuses on providing top-notch customer service to ensure a smooth claims experience for businesses.

- The dedicated claims representatives are trained to handle commercial auto insurance claims efficiently and effectively.

- Progressive's commitment to customer satisfaction reflects in their efforts to streamline the claims process and prioritize the needs of businesses.

- By offering 24/7 claims support and online tracking, Progressive aims to deliver a hassle-free experience for businesses navigating insurance claims.

Final Wrap-Up

Concluding our exploration of Progressive Commercial Auto Insurance: Cost vs Value, this final paragraph offers a concise summary of the key points discussed, leaving readers with a lasting impression of the importance of evaluating cost and value in commercial auto insurance.

General Inquiries

What factors influence the cost of Progressive Commercial Auto Insurance?

Factors such as coverage type, business size, driving history, and vehicle type can influence the cost of Progressive Commercial Auto Insurance.

What is the value proposition of Progressive Commercial Auto Insurance for businesses?

Progressive offers flexible coverage options, additional services, and benefits tailored to meet the specific needs of businesses, providing comprehensive protection and peace of mind.

How customizable is the coverage under Progressive Commercial Auto Insurance?

Progressive offers customizable coverage options that can be tailored to suit different business requirements, allowing businesses to select the most suitable coverage for their specific needs.

How does Progressive ensure a smooth claims experience for businesses?

Progressive has a streamlined claims process and dedicated customer service for commercial auto insurance, ensuring prompt assistance and efficient resolution of claims to minimize disruptions for businesses.