Top 5 Commercial Auto Policy Add-Ons Worth the Investment sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the realm of commercial auto insurance add-ons, we uncover the essential components that businesses should consider when enhancing their policy for optimal coverage and cost-saving benefits.

Top 5 Commercial Auto Policy Add-Ons Worth the Investment

Commercial auto insurance is essential for businesses that rely on vehicles to conduct their operations. While a standard policy provides basic coverage, add-ons can offer additional protection and benefits tailored to specific needs. It's crucial for businesses to carefully consider which add-ons to invest in to ensure comprehensive coverage and cost-effectiveness.

Importance of Add-Ons in Commercial Auto Insurance

Add-ons play a vital role in enhancing the coverage provided by a commercial auto insurance policy. They allow businesses to customize their insurance to meet specific needs and potential risks that may not be covered by a standard policy. By adding these extra protections, businesses can safeguard their assets, employees, and reputation in the event of an unforeseen incident.

Key Factors to Consider When Selecting Add-Ons

When selecting add-ons for a commercial auto insurance policy, businesses should consider factors such as the nature of their operations, the types of vehicles used, the driving habits of employees, and the specific risks they face. It's important to assess the potential impact of various scenarios on the business and choose add-ons that provide adequate protection against those risks.

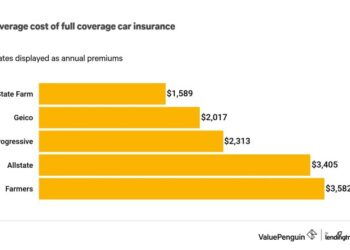

Potential Cost-Saving Benefits of Investing in Policy Add-Ons

While add-ons may come with an additional cost, they can also result in long-term cost savings for businesses. By investing in add-ons that offer protection against common risks or liabilities, businesses can avoid costly out-of-pocket expenses in the event of an accident or other covered incident.

Additionally, add-ons that promote safe driving habits or provide discounts for certain safety features can help businesses reduce their insurance premiums over time.

Comprehensive Coverage

Comprehensive coverage is an add-on to commercial auto insurance policies that provides protection against damage not caused by a collision. This type of coverage typically includes incidents such as theft, vandalism, weather-related damage, and accidents involving animals.

Detailing Comprehensive Coverage

Comprehensive coverage goes beyond the standard auto insurance policy, which usually only covers damages resulting from collisions with other vehicles or objects. By adding comprehensive coverage to a commercial auto policy, businesses can safeguard their vehicles against a wider range of risks.

- Comprehensive coverage protects vehicles from non-collision incidents like theft, vandalism, fire, and natural disasters.

- This type of coverage is especially valuable for businesses that operate in areas prone to extreme weather conditions or high rates of theft and vandalism.

- Comprehensive coverage can also provide financial protection in situations where a vehicle is damaged while parked, such as a tree falling on it or hail damage.

Comparing Comprehensive Coverage with Standard Auto Insurance

Comprehensive coverage differs from standard auto insurance by offering protection for a broader range of risks. While collision coverage focuses on accidents involving other vehicles or objects, comprehensive coverage extends this protection to include other types of damage that can occur to a vehicle.

- Standard auto insurance typically covers damages resulting from collisions with other vehicles or objects.

- Comprehensive coverage, on the other hand, includes protection against theft, vandalism, weather-related damage, and more.

- Businesses that opt for comprehensive coverage can enjoy greater peace of mind knowing their vehicles are protected from a wider array of risks.

Examples of Situations Where Comprehensive Coverage is Beneficial

Comprehensive coverage can be particularly beneficial for businesses in various scenarios where non-collision incidents can result in significant financial losses. Some examples include:

- A business vehicle is stolen from a parking lot overnight.

- Severe weather causes damage to a company car, such as hail damage or flooding.

- Vandalism results in extensive damage to a fleet vehicle while it is parked on the street.

Roadside Assistance

Roadside assistance is an essential add-on for commercial auto insurance policies, providing peace of mind and crucial support in case of emergencies on the road.

Services Included in Roadside Assistance Coverage

- Towing services to transport the vehicle to a repair shop or safe location.

- Jump-start services for a dead battery.

- Tire change assistance in case of a flat tire.

- Lockout services to help gain access to the vehicle if the keys are lost or locked inside.

- Fuel delivery to provide a limited amount of fuel if the vehicle runs out on the road.

Real-Life Scenarios

- Imagine a delivery truck breaking down on a busy highway during rush hour. Roadside assistance can quickly dispatch a tow truck to remove the vehicle from the traffic flow, minimizing disruptions and ensuring timely delivery of goods.

- In another scenario, a construction company's work truck experiences a flat tire at a remote job site. Roadside assistance can send a service provider to change the tire, allowing the crew to resume work without delays.

- For a business owner with a fleet of vehicles, roadside assistance can be a lifesaver when multiple vehicles encounter issues simultaneously, ensuring that operations continue smoothly and customer commitments are met.

Rental Reimbursement

When it comes to commercial vehicles, having rental reimbursement as an add-on to your policy can be a lifesaver in times of need. This coverage helps provide you with a temporary replacement vehicle while yours is being repaired after an accident, ensuring that your business operations can continue without major disruptions.

The Importance of Rental Reimbursement

Rental reimbursement is crucial for businesses that rely heavily on their commercial vehicles for day-to-day operations. In the event of an accident that leaves your vehicle unusable, having access to a rental vehicle can help minimize downtime and ensure that you can continue serving your customers without major interruptions.

- It is essential for businesses that cannot afford to be without a vehicle for an extended period.

- It helps maintain productivity and customer service levels by providing a temporary replacement vehicle.

- Having rental reimbursement coverage can give you peace of mind knowing that you have a backup plan in case of unexpected accidents.

Claiming Rental Reimbursement

In case of an accident, the process of claiming rental reimbursement is usually straightforward. After reporting the accident to your insurance company, they will guide you through the steps to arrange for a rental vehicle. Keep all documentation related to the accident and rental vehicle expenses to ensure a smooth reimbursement process.

- Contact your insurance company and provide them with the necessary information about the accident.

- Follow their instructions on how to proceed with renting a replacement vehicle.

- Keep all receipts and documents related to the rental vehicle expenses for reimbursement.

Minimizing Business Disruptions

Rental reimbursement can significantly minimize business disruptions by allowing you to quickly get back on the road with a temporary replacement vehicle. This helps maintain your business operations and customer service levels even in the face of unexpected accidents or vehicle downtime.

- Examples include delivery services being able to continue serving customers, contractors staying on schedule with their projects, and service-based businesses maintaining appointments with clients.

- Having rental reimbursement coverage can be the difference between a minor inconvenience and a major setback for your business.

Gap Insurance

Gap insurance in commercial auto policies covers the difference between the actual cash value of a vehicle and the amount still owed on a lease or loan in the event of a total loss. This add-on can protect a business from financial loss in situations where the vehicle is totaled and the insurance payout is not enough to cover the remaining balance.

Scenarios where Gap Insurance can protect a business financially

- Scenario 1: A business leases a vehicle for commercial use and the vehicle gets totaled in an accident. The insurance payout is not enough to cover the remaining lease balance, leaving the business responsible for the difference. Gap insurance would cover this shortfall, preventing the business from having to pay out of pocket.

- Scenario 2: A business has a loan on a commercial vehicle and the vehicle is stolen and not recovered. The insurance payout is based on the vehicle's actual cash value, which might be lower than the remaining loan balance. Gap insurance would step in to cover the difference, ensuring the business is not left with a financial burden.

How Gap Insurance works with other coverage options

Gap insurance works in conjunction with comprehensive coverage by providing additional financial protection in case of a total loss. While comprehensive coverage reimburses the actual cash value of the vehicle at the time of loss, gap insurance bridges the gap between this amount and the remaining balance on a lease or loan.

By adding gap insurance to a commercial auto policy, businesses can safeguard themselves against potential financial losses that may arise from a total loss scenario.

Outcome Summary

In conclusion, the top 5 commercial auto policy add-ons discussed above serve as invaluable assets for businesses looking to fortify their insurance coverage and protect their vehicles and operations. By investing in these add-ons, companies can navigate unforeseen challenges with confidence and financial security.

FAQ Resource

What factors should businesses consider when selecting add-ons?

Businesses should consider their specific operational needs, the types of risks they face, and their budget constraints when selecting add-ons for their commercial auto policy.

How does roadside assistance benefit businesses?

Roadside assistance provides timely support in case of emergencies such as breakdowns or accidents, ensuring minimal disruption to business operations and vehicle downtime.

When does gap insurance come into play for commercial vehicles?

Gap insurance becomes crucial when the value of a commercial vehicle is less than the outstanding loan amount, protecting the business from financial loss in case of a total loss incident.

Can rental reimbursement add-on cover all types of rental vehicles?

Rental reimbursement typically covers standard rental vehicles, but businesses may need to check their policy for any specific exclusions of certain types of rentals.

Are comprehensive coverage and gap insurance the same?

No, comprehensive coverage and gap insurance serve different purposes. Comprehensive coverage protects the vehicle from various risks, while gap insurance covers the difference between the vehicle's value and the amount owed on a loan or lease.