Embark on a journey through the future of commercial auto insurance with our comprehensive review of Progressive's latest offerings in 2025. From cutting-edge technologies to unparalleled customer service, discover what sets Progressive apart in the ever-evolving insurance landscape.

Delve deeper into the evolution of Progressive Commercial Auto Insurance, exploring the changes and innovations that have shaped the industry's future.

Overview of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance offers a range of key features tailored to meet the needs of businesses and commercial vehicle owners. With customizable coverage options and competitive rates, Progressive aims to provide comprehensive protection for commercial vehicles of all sizes.

Key Features of Progressive Commercial Auto Insurance

- Flexible coverage options to suit specific business needs

- 24/7 customer support for claims assistance and policy inquiries

- Discounts for safe driving records and multiple policies

- Ability to add on additional coverage such as roadside assistance and rental reimbursement

Benefits of Choosing Progressive for Commercial Auto Insurance

- Competitive rates to help businesses save on insurance costs

- Easy online account management for policy updates and payments

- Quick and efficient claims process to get businesses back on the road faster

- Dedicated support from knowledgeable insurance agents

Target Market for Progressive’s Commercial Auto Insurance Products

Progressive's commercial auto insurance products are ideal for small to medium-sized businesses that rely on vehicles for their operations. This can include businesses in industries such as delivery services, construction, landscaping, and more. By offering customizable coverage options and competitive rates, Progressive caters to the diverse needs of commercial vehicle owners.

Evolution of Progressive Commercial Auto Insurance by 2025

In the past few years, Progressive Commercial Auto Insurance has undergone significant changes and advancements to meet the evolving needs of businesses and drivers. Let's explore the key developments that have shaped Progressive's commercial auto insurance offerings by 2025.

Enhanced Coverage Options

- Since 2021, Progressive has expanded its coverage options to provide more tailored solutions for businesses of all sizes. This includes specialized policies for different industries, such as construction, delivery services, and transportation.

- Progressive now offers customizable coverage limits, deductibles, and add-on features to allow businesses to create a policy that fits their unique requirements.

- With the introduction of new coverage options like cyber liability insurance and business interruption insurance, Progressive has adapted to the changing landscape of risks faced by commercial drivers.

Integration of Telematics Technology

- One of the most significant advancements in Progressive's commercial auto insurance sector is the integration of telematics technology. By installing telematics devices in commercial vehicles, businesses can track driver behavior, monitor vehicle performance, and receive real-time insights to improve safety and efficiency.

- Telematics data can also be used to offer usage-based insurance (UBI) policies, where premiums are based on actual driving habits and patterns. This personalized approach to pricing has become increasingly popular among commercial drivers looking to lower their insurance costs.

Streamlined Claims Process

- Progressive has implemented digital tools and platforms to streamline the claims process for commercial auto insurance customers. Businesses can now file claims online, upload documentation, and track the status of their claims in real time.

- By leveraging automation and artificial intelligence, Progressive has reduced claims processing times and improved the overall customer experience for commercial policyholders.

Customer Experience with Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance has garnered a reputation for providing positive customer experiences through various aspects of their services.

Positive Customer Experiences

- Efficient Claims Process: Customers have praised Progressive for their quick and hassle-free claims process, allowing them to get back on the road without delays.

- Customized Coverage Options: Progressive offers a range of coverage options tailored to meet the specific needs of each business, providing flexibility and peace of mind to customers.

- 24/7 Customer Support: With round-the-clock customer support, clients have appreciated the convenience of being able to reach Progressive at any time for assistance.

Challenges and Criticisms

- Premium Costs: Some customers have expressed concerns about the premium costs of Progressive's commercial auto insurance, stating that they may be higher compared to other providers.

- Claim Denials: A few customers have faced challenges with claim denials, leading to frustration and dissatisfaction with the claims process.

- Communication Issues: There have been instances where customers have reported communication issues with Progressive representatives, causing delays in resolving issues.

Customer Satisfaction Ratings

- According to customer satisfaction surveys, Progressive has received high ratings for its claims handling process, with many customers expressing satisfaction with the efficiency and professionalism of the claims team.

- Customer feedback indicates that Progressive's online tools and resources are user-friendly and help streamline the insurance management process for businesses.

- While there have been criticisms, Progressive continues to work on improving customer experience and addressing issues raised by clients to enhance overall satisfaction levels.

Market Position and Competition

Progressive has solidified its market position in the commercial auto insurance industry by 2025, becoming one of the leading providers in the market. Its innovative approach to insurance, customer-centric focus, and competitive offerings have helped it gain a significant market share.

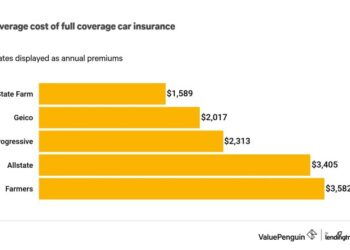

Comparison with Competitors

- Coverage: Progressive offers a wide range of coverage options tailored to the needs of commercial auto customers. Their customizable policies provide flexibility and comprehensive protection for businesses of all sizes.

- Pricing: Progressive's competitive pricing strategy has allowed them to attract a diverse customer base. They offer affordable rates without compromising on the quality of service or coverage.

- Customer Service: Progressive is known for its exceptional customer service, with dedicated agents and convenient online tools to assist policyholders. Their quick claims processing and responsive support have set them apart from competitors.

Partnerships and Collaborations

Progressive has formed strategic partnerships and collaborations with various organizations in the industry to enhance its market position. By working with technology companies, fleet management firms, and industry associations, Progressive has been able to offer innovative solutions and expand its reach in the market.

Conclusive Thoughts

As we conclude our exploration of Progressive Commercial Auto Insurance: A 2025 Review, it's evident that Progressive continues to lead the way in revolutionizing the commercial auto insurance sector. With a commitment to excellence and customer satisfaction, Progressive remains a top choice for businesses looking for reliable insurance solutions.

Q&A

What are the key features of Progressive Commercial Auto Insurance?

Progressive offers customizable coverage options, 24/7 customer support, and competitive pricing for commercial vehicles.

Are there any new technologies introduced by Progressive in their commercial auto insurance sector for 2025?

Yes, Progressive has implemented telematics devices and AI-driven analytics tools to enhance safety and efficiency in commercial auto insurance.

How does Progressive's market position in the commercial auto insurance industry by 2025 compare to competitors?

Progressive maintains a strong market position with innovative offerings and competitive pricing, setting it apart from competitors in the industry.

Embark on a journey through the future of commercial auto insurance with our comprehensive review of Progressive's latest offerings in 2025. From cutting-edge technologies to unparalleled customer service, discover what sets Progressive apart in the ever-evolving insurance landscape.

Delve deeper into the evolution of Progressive Commercial Auto Insurance, exploring the changes and innovations that have shaped the industry's future.

Overview of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance offers a range of key features tailored to meet the needs of businesses and commercial vehicle owners. With customizable coverage options and competitive rates, Progressive aims to provide comprehensive protection for commercial vehicles of all sizes.

Key Features of Progressive Commercial Auto Insurance

- Flexible coverage options to suit specific business needs

- 24/7 customer support for claims assistance and policy inquiries

- Discounts for safe driving records and multiple policies

- Ability to add on additional coverage such as roadside assistance and rental reimbursement

Benefits of Choosing Progressive for Commercial Auto Insurance

- Competitive rates to help businesses save on insurance costs

- Easy online account management for policy updates and payments

- Quick and efficient claims process to get businesses back on the road faster

- Dedicated support from knowledgeable insurance agents

Target Market for Progressive’s Commercial Auto Insurance Products

Progressive's commercial auto insurance products are ideal for small to medium-sized businesses that rely on vehicles for their operations. This can include businesses in industries such as delivery services, construction, landscaping, and more. By offering customizable coverage options and competitive rates, Progressive caters to the diverse needs of commercial vehicle owners.

Evolution of Progressive Commercial Auto Insurance by 2025

In the past few years, Progressive Commercial Auto Insurance has undergone significant changes and advancements to meet the evolving needs of businesses and drivers. Let's explore the key developments that have shaped Progressive's commercial auto insurance offerings by 2025.

Enhanced Coverage Options

- Since 2021, Progressive has expanded its coverage options to provide more tailored solutions for businesses of all sizes. This includes specialized policies for different industries, such as construction, delivery services, and transportation.

- Progressive now offers customizable coverage limits, deductibles, and add-on features to allow businesses to create a policy that fits their unique requirements.

- With the introduction of new coverage options like cyber liability insurance and business interruption insurance, Progressive has adapted to the changing landscape of risks faced by commercial drivers.

Integration of Telematics Technology

- One of the most significant advancements in Progressive's commercial auto insurance sector is the integration of telematics technology. By installing telematics devices in commercial vehicles, businesses can track driver behavior, monitor vehicle performance, and receive real-time insights to improve safety and efficiency.

- Telematics data can also be used to offer usage-based insurance (UBI) policies, where premiums are based on actual driving habits and patterns. This personalized approach to pricing has become increasingly popular among commercial drivers looking to lower their insurance costs.

Streamlined Claims Process

- Progressive has implemented digital tools and platforms to streamline the claims process for commercial auto insurance customers. Businesses can now file claims online, upload documentation, and track the status of their claims in real time.

- By leveraging automation and artificial intelligence, Progressive has reduced claims processing times and improved the overall customer experience for commercial policyholders.

Customer Experience with Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance has garnered a reputation for providing positive customer experiences through various aspects of their services.

Positive Customer Experiences

- Efficient Claims Process: Customers have praised Progressive for their quick and hassle-free claims process, allowing them to get back on the road without delays.

- Customized Coverage Options: Progressive offers a range of coverage options tailored to meet the specific needs of each business, providing flexibility and peace of mind to customers.

- 24/7 Customer Support: With round-the-clock customer support, clients have appreciated the convenience of being able to reach Progressive at any time for assistance.

Challenges and Criticisms

- Premium Costs: Some customers have expressed concerns about the premium costs of Progressive's commercial auto insurance, stating that they may be higher compared to other providers.

- Claim Denials: A few customers have faced challenges with claim denials, leading to frustration and dissatisfaction with the claims process.

- Communication Issues: There have been instances where customers have reported communication issues with Progressive representatives, causing delays in resolving issues.

Customer Satisfaction Ratings

- According to customer satisfaction surveys, Progressive has received high ratings for its claims handling process, with many customers expressing satisfaction with the efficiency and professionalism of the claims team.

- Customer feedback indicates that Progressive's online tools and resources are user-friendly and help streamline the insurance management process for businesses.

- While there have been criticisms, Progressive continues to work on improving customer experience and addressing issues raised by clients to enhance overall satisfaction levels.

Market Position and Competition

Progressive has solidified its market position in the commercial auto insurance industry by 2025, becoming one of the leading providers in the market. Its innovative approach to insurance, customer-centric focus, and competitive offerings have helped it gain a significant market share.

Comparison with Competitors

- Coverage: Progressive offers a wide range of coverage options tailored to the needs of commercial auto customers. Their customizable policies provide flexibility and comprehensive protection for businesses of all sizes.

- Pricing: Progressive's competitive pricing strategy has allowed them to attract a diverse customer base. They offer affordable rates without compromising on the quality of service or coverage.

- Customer Service: Progressive is known for its exceptional customer service, with dedicated agents and convenient online tools to assist policyholders. Their quick claims processing and responsive support have set them apart from competitors.

Partnerships and Collaborations

Progressive has formed strategic partnerships and collaborations with various organizations in the industry to enhance its market position. By working with technology companies, fleet management firms, and industry associations, Progressive has been able to offer innovative solutions and expand its reach in the market.

Conclusive Thoughts

As we conclude our exploration of Progressive Commercial Auto Insurance: A 2025 Review, it's evident that Progressive continues to lead the way in revolutionizing the commercial auto insurance sector. With a commitment to excellence and customer satisfaction, Progressive remains a top choice for businesses looking for reliable insurance solutions.

Q&A

What are the key features of Progressive Commercial Auto Insurance?

Progressive offers customizable coverage options, 24/7 customer support, and competitive pricing for commercial vehicles.

Are there any new technologies introduced by Progressive in their commercial auto insurance sector for 2025?

Yes, Progressive has implemented telematics devices and AI-driven analytics tools to enhance safety and efficiency in commercial auto insurance.

How does Progressive's market position in the commercial auto insurance industry by 2025 compare to competitors?

Progressive maintains a strong market position with innovative offerings and competitive pricing, setting it apart from competitors in the industry.