Delve into the intricate world of auto policy quotes with The Ultimate Guide to Understanding Auto Policy Quotes. Unravel the complexities, discover hidden savings, and gain a deeper insight into this essential aspect of insurance.

Explore the nuances of factors affecting quotes, learn how to compare quotes effectively, and uncover valuable tips for saving on auto insurance premiums.

Understanding Auto Policy Quotes

When it comes to getting auto insurance, understanding policy quotes is crucial for making informed decisions that fit your needs and budget. By grasping the key terms and factors that affect auto policy quotes, you can better compare offers from different insurance companies and find the best coverage for your vehicle.

Key Terms and Factors in Auto Policy Quotes

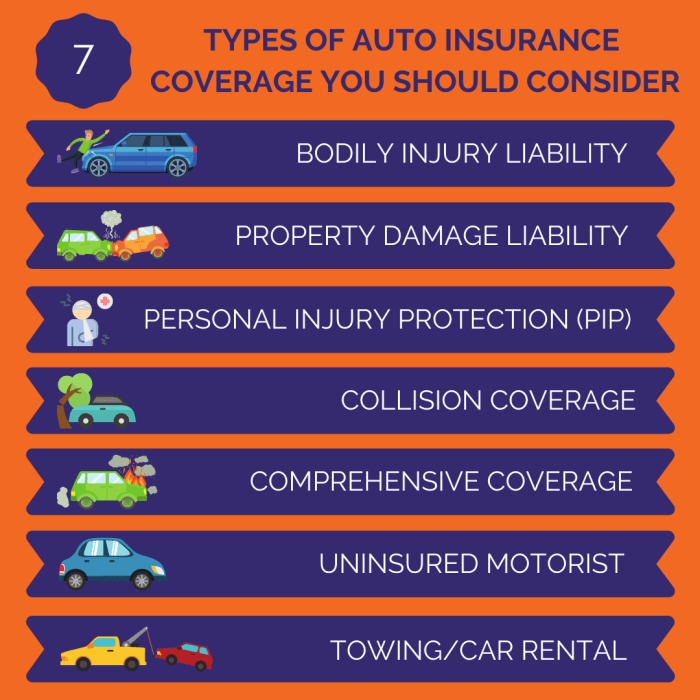

Auto policy quotes consist of various elements that determine the cost and coverage of your insurance. Some key terms and factors to consider include:

- Liability Coverage: This protects you if you're at fault in an accident and covers the other party's medical bills and property damage.

- Collision Coverage: This pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: This covers damages to your car from non-collision incidents like theft, vandalism, or natural disasters.

- Deductible: The amount you pay out of pocket before your insurance kicks in.

- Driving Record: Your history of accidents and violations can impact your quote.

- Vehicle Model: The make, model, and age of your car can influence the cost of insurance.

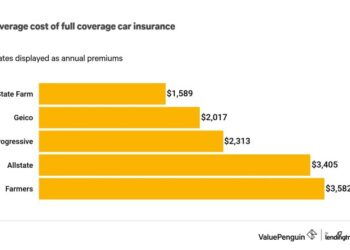

How Auto Policy Quotes Vary Between Insurance Companies

Auto policy quotes can vary significantly between insurance companies due to several reasons:

- Underwriting Criteria: Each insurer has its own underwriting criteria and risk assessment methods, which can result in different quotes for the same driver.

- Discounts and Incentives: Insurers offer various discounts for factors like safe driving, bundling policies, or having certain safety features in your car.

- Coverage Options: Different insurers may offer varying levels of coverage and additional options that can affect the overall quote.

- Claim Handling: The reputation and efficiency of an insurer in handling claims can impact the cost of your policy.

Factors Affecting Auto Policy Quotes

When you are looking for an auto insurance policy, there are several factors that can influence the quotes you receive. These factors play a crucial role in determining how much you will pay for your coverage.

Driving Record

Your driving record is one of the most significant factors that impact your auto policy quotes. Insurance companies assess your history of accidents, traffic violations, and claims to determine the level of risk you pose as a driver. A clean driving record with no accidents or tickets will typically result in lower premiums, while a history of accidents and violations may lead to higher insurance costs.

Age and Gender

Age and gender also play a role in determining auto policy quotes. Statistics show that younger drivers, especially teenagers, are more likely to be involved in accidents compared to older, more experienced drivers. As a result, younger drivers typically face higher insurance premiums.

Additionally, gender can also impact rates, with young male drivers often facing higher costs than their female counterparts.

Type of Vehicle

The type of vehicle you drive can significantly affect the cost of your auto insurance. Insurance companies take into account factors such as the make and model of your car, its safety features, and its likelihood of theft when determining your premium.

Generally, expensive or high-performance vehicles will have higher insurance costs compared to more affordable and reliable models.

Comparing Auto Policy Quotes

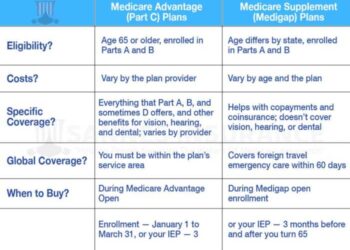

When looking to compare auto policy quotes from different providers, it's essential to consider various factors that can impact the cost and coverage of your policy. Understanding the key differences between comprehensive and liability insurance quotes, as well as reviewing coverage limits, can help you make an informed decision.

Key Differences Between Comprehensive and Liability Insurance Quotes

- Comprehensive Insurance: This type of coverage typically protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters. Comprehensive insurance quotes may be higher due to the broader coverage it offers.

- Liability Insurance: Liability insurance covers damages and injuries to others in an accident where you are at fault. Quotes for liability insurance tend to be lower compared to comprehensive coverage, as it only covers the other party involved.

Importance of Reviewing Coverage Limits

When comparing auto policy quotes, it's crucial to review the coverage limits offered by each provider. The coverage limits determine the maximum amount your insurer will pay for a covered claim. Make sure to consider your financial situation and the value of your assets when selecting coverage limits.

Opting for lower limits may result in cheaper quotes, but could leave you financially vulnerable in the event of an accident.

Tips for Saving on Auto Insurance

When it comes to auto insurance, there are various strategies you can implement to lower your policy quotes and save money in the long run. From bundling insurance policies to adjusting deductibles, these tips can help you secure affordable coverage without compromising on quality.

Bundling Insurance Policies

One effective way to save on auto insurance is by bundling your policies. This involves purchasing multiple insurance products, such as auto and home insurance, from the same provider. By doing so, insurance companies often offer discounts on each policy, resulting in significant cost savings for you.

Impact of Deductibles

Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can lower your auto insurance premiums. However, it's essential to consider your financial situation and ability to cover the deductible in the event of a claim.

Finding the right balance between a reasonable deductible and affordable premiums is key to saving on auto insurance.

Final Conclusion

In conclusion, The Ultimate Guide to Understanding Auto Policy Quotes equips you with the knowledge needed to navigate the world of auto insurance with confidence. Armed with this information, you can make informed decisions and secure the best possible coverage at the right price.

Detailed FAQs

How do I effectively compare auto policy quotes?

To compare quotes efficiently, gather quotes from multiple providers, ensure the coverage limits are similar, and consider both price and coverage benefits.

What impact do deductibles have on auto insurance premiums?

Higher deductibles typically result in lower premiums, as you agree to pay more out of pocket in the event of a claim.

Is bundling insurance policies a good way to save on auto insurance?

Yes, bundling multiple insurance policies with the same provider often leads to discounts and cost savings on auto insurance.

How can I lower my auto policy quotes?

You can lower your quotes by maintaining a clean driving record, opting for a safe vehicle, and exploring available discounts with your insurance provider.