Embarking on the journey of discovering how to obtain free or low-cost Medicare Advantage Plans opens up a world of possibilities and opportunities for individuals seeking quality healthcare coverage without breaking the bank. As we delve into the intricacies of this topic, you'll uncover valuable insights and strategies to help you navigate the complex landscape of healthcare options.

Delving deeper into the specifics, we will explore key aspects such as eligibility criteria, coverage options, enrollment periods, and maximizing benefits with Medicare Advantage Plans, ensuring you are equipped with the knowledge to make informed decisions regarding your healthcare needs.

Researching Medicare Advantage Plans

When looking into Medicare Advantage Plans, it's essential to understand the key differences between these plans and Original Medicare. Medicare Advantage Plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage like prescription drugs, dental, vision, and hearing.

Differences Between Medicare Advantage Plans and Original Medicare

- Medicare Advantage Plans are offered by private insurance companies, while Original Medicare is provided by the federal government.

- Medicare Advantage Plans typically have networks of doctors and hospitals, while Original Medicare allows you to see any provider that accepts Medicare.

- Medicare Advantage Plans may offer extra benefits like dental, vision, or prescription drug coverage, which are not included in Original Medicare.

Eligibility Criteria for Medicare Advantage Plans

- You must be enrolled in Medicare Part A and Part B to join a Medicare Advantage Plan.

- You must live in the plan's service area.

- Most plans require you to not have end-stage renal disease (ESRD).

Coverage Options with Medicare Advantage Plans

Medicare Advantage Plans offer a variety of coverage options beyond Original Medicare, including:

- Prescription drug coverage (Medicare Part D).

- Extra benefits like dental, vision, and hearing coverage.

- Wellness programs and gym memberships.

Importance of Comparing Different Plans

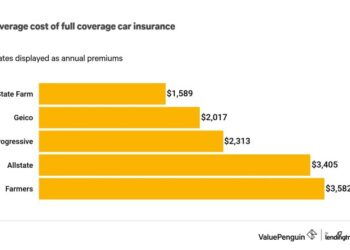

Before choosing a Medicare Advantage Plan, it's crucial to compare different plans to find one that meets your healthcare needs and budget. Factors to consider when comparing plans include:

- Monthly premiums, deductibles, and out-of-pocket costs.

- Coverage for prescription drugs and other services.

- Doctor and hospital networks.

- Ratings and reviews of the plan from current members.

Finding Free or Low-Cost Medicare Advantage Plans

Finding a free or low-cost Medicare Advantage plan can be crucial for those on a tight budget or fixed income. Luckily, there are various resources and programs available to assist individuals in finding affordable options. Here are some tips and organizations that can help:

Organizations and Resources for Assistance

- State Health Insurance Assistance Programs (SHIPs): SHIPs offer free, personalized counseling and assistance to Medicare beneficiaries. They can help you compare Medicare Advantage plans in your area and find one that fits your budget.

- The Medicare Rights Center: This non-profit organization provides information and assistance to people with Medicare. They have a helpline and online resources to help you navigate the Medicare system and find low-cost plans.

Navigating the Medicare Website

- Visit the official Medicare website and use the Plan Finder tool to search for Medicare Advantage plans in your area. You can compare costs, coverage options, and ratings to find an affordable plan that meets your needs.

- Make sure to enter accurate information about your location, current medications, and healthcare needs to get the most relevant results.

State-Specific Programs for Assistance

- Many states offer programs that help low-income individuals pay for Medicare costs, including premiums, deductibles, and co-pays. Check with your state's Medicaid office or Department of Health for information on available programs.

- State Pharmaceutical Assistance Programs (SPAPs) may also provide additional help with prescription drug costs for Medicare beneficiaries who qualify based on income and other criteria.

Qualifying for Extra Help

- Extra Help, also known as the Low-Income Subsidy (LIS) program, is a federal program that helps Medicare beneficiaries with limited income and resources pay for prescription drug costs. To qualify, you must meet certain income and asset limits set by the Social Security Administration.

- Applying for Extra Help involves completing an application form, either online, over the phone, or in person. If approved, you could receive assistance with premiums, deductibles, and co-pays for your Medicare Part D prescription drug coverage.

Understanding Enrollment Periods

Enrollment periods play a crucial role in signing up for Medicare Advantage Plans. It is essential to understand the different periods to make informed decisions about your healthcare coverage.

Initial Enrollment Period for Medicare Advantage Plans

The Initial Enrollment Period is the first opportunity for most people to enroll in a Medicare Advantage Plan. It typically spans seven months, including the three months before you turn 65, your birthday month, and the three months after.

Special Enrollment Periods

Special Enrollment Periods allow individuals to enroll in or switch Medicare Advantage Plans outside the regular enrollment periods. Qualifying circumstances may include moving to a new area, losing employer coverage, or other specific situations.

Annual Enrollment Period

The Annual Enrollment Period occurs each year from October 15th to December 7th. During this time, individuals can make changes to their Medicare Advantage Plans, including switching to a different plan or opting for Original Medicare.

Choosing the Best Time to Enroll

- Consider your individual healthcare needs and circumstances before selecting an enrollment period.

- Review plan options during the Annual Enrollment Period to ensure your coverage aligns with your current needs.

- If you qualify for a Special Enrollment Period, take advantage of the opportunity to make changes outside the regular enrollment periods.

Maximizing Benefits with Medicare Advantage Plans

When it comes to maximizing benefits with Medicare Advantage Plans, there are several strategies you can employ to reduce out-of-pocket costs and take advantage of additional benefits offered by certain plans.One key strategy is to review your plan annually to ensure it still meets your needs.

Plans can change each year, so it's important to make sure you are still getting the coverage you need at a price you can afford.

Reducing Out-of-Pocket Costs

- Look for plans with low or no deductibles to minimize upfront costs.

- Take advantage of in-network providers to lower co-pays and coinsurance.

- Consider plans that offer prescription drug coverage to save on medication costs.

- Utilize preventive services covered by Medicare Advantage Plans to avoid costly treatments down the line.

Additional Benefits Offered

- Some plans may offer dental, vision, hearing, or fitness benefits that can help you save on these essential services.

- Look for plans with transportation benefits to help you get to and from medical appointments.

- Consider plans with telehealth services for convenient access to healthcare from home.

Conclusive Thoughts

In conclusion, the quest for obtaining free or low-cost Medicare Advantage Plans is not just about saving money—it's about securing peace of mind and access to essential healthcare services. By utilizing the information presented here, you are empowered to make confident choices that prioritize your well-being and financial stability.

FAQ Overview

How can I qualify for Extra Help to reduce prescription drug costs?

To qualify for Extra Help, you must have limited income and resources. You can apply through the Social Security Administration or Medicaid office.

What are Special Enrollment Periods for Medicare Advantage Plans?

Special Enrollment Periods allow individuals to enroll in or switch Medicare Advantage Plans outside the regular enrollment periods due to specific circumstances, such as moving to a new area with different plan options.

Why is it important to review plan changes annually with Medicare Advantage Plans?

Reviewing plan changes annually ensures that your chosen plan still meets your healthcare needs and budget, as plans may adjust coverage, costs, or benefits each year.

How do I navigate the Medicare website to search for affordable plans?

You can visit the official Medicare website and use the plan finder tool to compare different Medicare Advantage Plans based on costs, coverage, and quality ratings.