Embark on a journey of understanding the nuances between Medicare Advantage and Supplemental Plans. Delve into the intricacies of coverage, costs, and network restrictions to make informed decisions about your healthcare options.

Explore the key differences and benefits of each plan type, unraveling the complexities of Medicare choices for eligible individuals.

Understanding Medicare Advantage and Supplemental Plans

Medicare Advantage and Supplemental Plans are two options available to enhance traditional Medicare coverage. These plans offer additional benefits and coverage beyond what original Medicare provides.

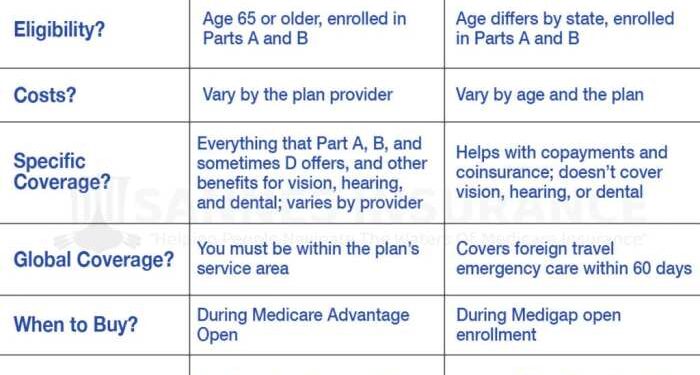

Differences Between Medicare Advantage and Supplemental Plans

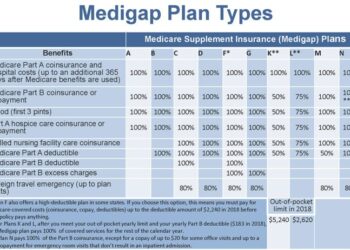

Medicare Advantage Plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. These plans typically include coverage for medical services, prescription drugs, and sometimes extra benefits like dental or vision care. On the other hand, Medicare Supplemental Plans, or Medigap, are designed to fill in the "gaps" left by original Medicare, such as copayments, coinsurance, and deductibles.

Key Features of Medicare Advantage and Supplemental Plans

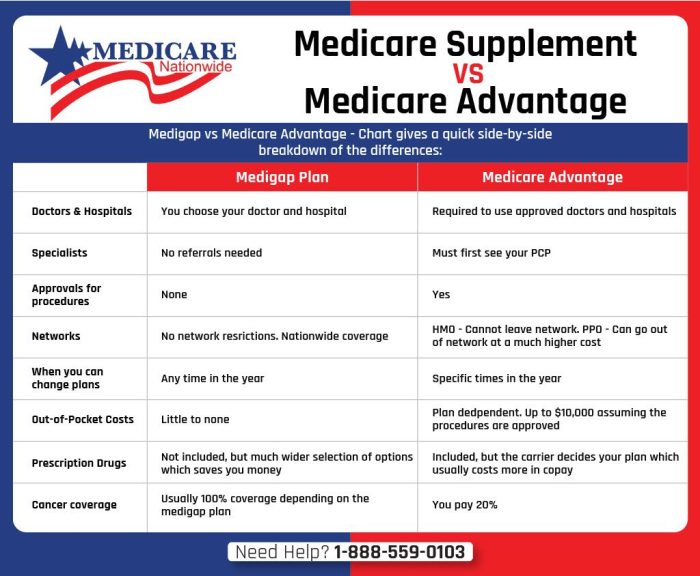

- Medicare Advantage Plans usually have networks of doctors and hospitals that members must use, while Supplemental Plans allow more flexibility in choosing healthcare providers.

- Medicare Advantage Plans often include prescription drug coverage, whereas Supplemental Plans do not typically cover medications.

- Medicare Supplemental Plans are standardized across different insurance companies, with each plan offering the same basic benefits regardless of the provider.

Eligibility for Medicare Advantage and Supplemental Plans

Individuals who are already enrolled in Medicare Part A and Part B are eligible to enroll in a Medicare Advantage Plan. However, eligibility for Supplemental Plans may vary by state and insurance company, but generally, individuals must be enrolled in Medicare Part A and Part B to qualify.

Situations Where One Plan May be More Suitable than the Other

- If you prefer a more comprehensive coverage with added benefits like dental and vision care, a Medicare Advantage Plan may be a better option.

- On the other hand, if you want more flexibility in choosing healthcare providers and are willing to pay higher premiums to reduce out-of-pocket costs, a Medicare Supplemental Plan could be more suitable.

Coverage and Benefits

When comparing Medicare Advantage and Supplemental Plans, it's important to understand the coverage and benefits offered by each type of plan.

Coverage Provided

- Medicare Advantage Plans: These plans typically cover all services provided by Original Medicare (Part A and Part B) and may include additional benefits such as prescription drug coverage, vision, dental, hearing, and wellness programs.

- Supplemental Plans: Also known as Medigap, these plans help pay for certain costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Common Benefits

- Hospitalization coverage

- Doctor visits

- Preventive care services

- Prescription drug coverage (in some plans)

Additional Benefits

- Medicare Advantage Plans:

- Extra benefits like vision, dental, and hearing coverage

- Wellness programs and gym memberships

- Prescription drug coverage included in most plans

- Supplemental Plans:

- Help with out-of-pocket costs not covered by Original Medicare

- Flexibility to see any doctor or specialist that accepts Medicare

- Coverage for emergency care when traveling abroad

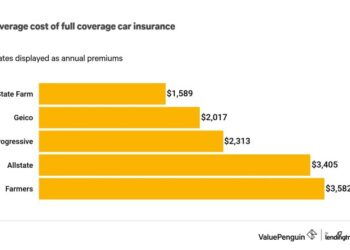

Costs and Premiums

When it comes to Medicare Advantage and Supplemental Plans, understanding the costs and premiums associated with each type of plan is crucial for making an informed decision about your healthcare coverage.

Cost Differences

Medicare Advantage Plans typically have lower monthly premiums compared to Medicare Supplemental Plans. This is because Medicare Advantage Plans are offered through private insurance companies and are subsidized by the government, while Supplemental Plans require higher premiums since they provide more comprehensive coverage.

Out-of-Pocket Expenses

Medicare Advantage Plans often have lower out-of-pocket expenses, such as copayments and coinsurance, for services like doctor visits and prescription drugs. On the other hand, Supplemental Plans may have higher premiums but lower out-of-pocket costs, giving you more predictability in your healthcare spending.

Premium Structures

For Medicare Advantage Plans, premiums are typically structured based on the level of coverage and additional benefits offered by the plan. These premiums can vary depending on the insurance company and the region you live in. In contrast, Supplemental Plans have standardized premiums based on the plan type (e.g., Plan F, Plan G) and may increase annually with inflation or other factors.

Network Restrictions and Flexibility

When considering Medicare Advantage and Supplemental Plans, it's important to understand the network restrictions and flexibility associated with each type of plan.Medicare Advantage Plans typically have network restrictions, meaning you may need to use healthcare providers within a specific network to receive coverage for services.

These plans often have preferred provider organizations (PPOs) or health maintenance organizations (HMOs) that limit your choice of doctors and hospitals. On the other hand, Supplemental Plans, also known as Medigap plans, provide more flexibility in choosing healthcare providers. These plans generally allow you to see any doctor or specialist who accepts Medicare patients.

Network Restrictions for Medicare Advantage and Supplemental Plans

- Medicare Advantage Plans have network restrictions that require you to use in-network providers to receive full coverage.

- Supplemental Plans offer more flexibility, allowing you to see any healthcare provider that accepts Medicare patients.

Flexibility in Choosing Healthcare Providers

- With Medicare Advantage Plans, you may be limited to a specific network of providers, which can impact your choice of doctors and hospitals.

- Supplemental Plans give you the freedom to see any doctor or specialist who accepts Medicare, providing more flexibility in accessing care.

Scenarios Impacting Choice Between Plans

- If you have a preferred doctor or specialist who is not in the network of a Medicare Advantage Plan, you may opt for a Supplemental Plan to continue seeing that provider.

- In rural areas with limited healthcare providers, a Supplemental Plan's flexibility may be more beneficial than a Medicare Advantage Plan with network restrictions.

Epilogue

In conclusion, navigating the realm of Medicare Advantage and Supplemental Plans offers a unique insight into healthcare options. By weighing the coverage, costs, and flexibility of each plan, individuals can make tailored choices that suit their specific needs.

Frequently Asked Questions

Who is eligible for Medicare Advantage and Supplemental Plans?

Eligibility for Medicare Advantage and Supplemental Plans varies, but generally, individuals aged 65 and older qualify. Some younger individuals with certain disabilities may also be eligible. It's best to check specific requirements with Medicare.

How do costs differ between Medicare Advantage and Supplemental Plans?

Medicare Advantage plans typically have lower premiums but may have higher out-of-pocket costs. Supplemental Plans, on the other hand, have higher premiums but lower out-of-pocket costs. It's essential to consider your healthcare needs when choosing between the two.

Are there additional benefits unique to either Medicare Advantage or Supplemental Plans?

Yes, Medicare Advantage plans often include prescription drug coverage and may offer additional services like dental or vision care. Supplemental Plans, also known as Medigap, provide coverage for certain out-of-pocket costs that Original Medicare doesn't cover.